The results of the YouGov survey showed that 50% of online customers would rather cancel their purchase if their preferred method of payment was unavailable. 40% of respondents mentioned that they feel more convenient when purchasing in web stores that offer a certain freedom of choice when it comes to payment methods. Just imagine how you can increase your sales, successful deals and customer loyalty just with a right Magento payment solution.

Find more statistics at Statista

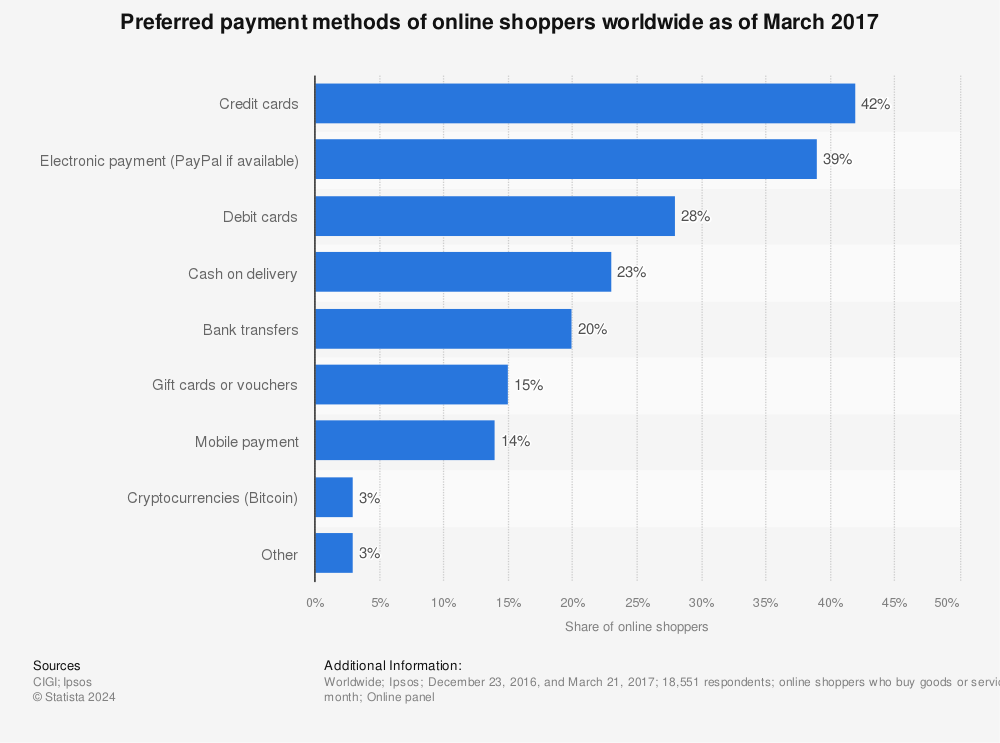

Online payment methods differ around the World.

For your customers’ comfort you need to provide payment methods typically preferred by the target market. Some gateways have a limited number of these methods, **so pay attention to available payment ways in Magento payment solution. **

Don’t muddle up payments gateways and merchant accounts. Let us get all this straighten out. What is payment gateway? Payment gateway is an eCommerce application that facilitates transferring the information between website and acquiring bank. On the other hand, merchant account is a storage where your money are stored before being sent into a bank account. Some of the solutions currently available on the market provide both tools’ functionality on a single platform but some offer just one of the given services. Notice that credit card payment gateway takes different amount of money for its implementation. There are 3 most popular fee types:

- setup fees

- monthly fees

- transactional fees.

Payment solutions can take only transaction fees or charge additive fees. Make sure that you are avare of all fees of your Magento payment gateway integration.

Processing credit card data securely. Choose gateway with** anti-fraud protection** that provide data encryption and allows CVV2 verification.

High risk credit card processing is an additive feature, so check it if your business is dealing with gambling, ebooks, electronic cigarettes, adult content or other risky sectors.

24/7 customer support is a must.

Some eCommerce payment gateways provide limited transactions and other restrictions which is why they are suitable for small business only. So pay attention to scalability of Magento payment gateway extensions.

Pay close attention to the contract term as you will not be able to change the gateway during this period.

Let’s review benefits of the most popular Magento payment gateways.

| 2Checkout Payment Extension | Authorize.net CIM-Certified by Authorize.Net-Payment Module | Braintree Payments | ebizmarts - Sage Pay Suite CE Europe - (SagePay OFFICIAL Extension) | WePay Payment Gateway | Dwolla | |||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Extension Price | Free | $ 249 | Free | $ 45 | Free | |||||||||||||||||||||||||||||

| Payment Methods |

|

|

|

|

|

|

||||||||||||||||||||||||||||

| Secure checkout | + | + | + | + | + | + | ||||||||||||||||||||||||||||

| Account Updater | + | + | + | - | - | + | ||||||||||||||||||||||||||||

| Recurring/ Subscription Billing | + | + | + | - | - | + | ||||||||||||||||||||||||||||

| Fraud protection |

|

|

|

|

|

|

</tr>

Mobile Payments |

Free 2Checkout Mobile App for merchants |

|

Mobile App |

Mobile App enables to sell Magento products within retail stores |

Developers can develop custom mobile app for your store |

Free Mobile App |

Rates |

Price per wallet- or card-based transaction is around 2.9% + $0.30.

|

Price per chargeback is around $25.</br> No monthly fees, no setup fees</br> Price per wallet- or card-based transaction is around 2.9% + $0.30.

|

Setup $49</br> Monthly Gateway $25</br> Chargeback $25</br> Price per wallet- or card-based transaction is around 2.9% + $0.30.

|

Price per chargeback is around $15.</br> 0 – 1000 transactions per quarter – 25 GBP per month, any extra transactions costing an extra 10p each.

|

High cancellation fee</br> Price per wallet- or card-based transaction is around 2.9% + $0.30.

|

Price per chargeback is around $15.</br> No monthly fees.

|

Free fee transactions under $10.l.</br> Fees for every transaction over $10 are $0.25.</br> Customer Support |

Web form email |

|

|

|

|

|

Notes |

Some errors may occur while working with custom themes. |

Accept international transactions but your business must be based in the United States, Canada, United Kingdom, Europe or Australia. |

Payment Methods differ depending on a region.

Generally, there is no difference whether you create a mobile app, website, or both - Braintree covers nearly all fronts, platforms, and device.

Also, it doesn’t have single-transaction limits. It accepts 130 + International currencies. Customer can save, add and edit stored credit card. 2 business day payout. |

Provide funds receiving within 2 business days. Sage Payment Solutions charges an early termination fee. To cancel Sage Payment contract they charge you a set amount multiplied by the number of months left in your contract. Contract Duration - 3-years. |

Extension is fully open-source and extremely easy to use.

WePay allows making purchases without having an account. |

Send and receive one-time,recurring, or mass payments with a free account.

Dwolla works with USD only and only in US. Restrictions: personal transactions are limited to $5,000 while business ones – to $10,000. Supported credit cards depend on the linked bank account. |

|